Gold Rush in Artificial Intelligence Funding - Numbers tell the Real Story

Since the release of ChatGPT-3.0, and even before that, there has been widespread buzz around machine learning models, generative AI, and their tremendous potential for business and commercial applications.

As with any new piece of the technology or innovation, investors have been consistently trying to identify ways to create shareholder value by identifying profitable endeavors in the Artificial intelligence space and those who can leverage the new technology to maximize business outcomes.

As we've seen in the past however, investments aren't always distributed equitably. In fact, in many cases the investment decisions seem quite questionable and in rare cases, are seemingly made based on a superficial understanding of impact the technology is creating on the business.

Historically, we've experienced this same phenomenon with the dotcom bubble during the early 2000s, where any business that was merely associated with "internet" or the "web" could easily raise huge sums of money from unsuspecting investors with deep pockets who were keen to jump onto the "next big thing".

This phenomenon resulted in the demise of many internet startups but also paved the way to several more in the future, many of which are behemoths today.

We are hearing similar stores with Artificial intelligence today, wherein companies that are associated with machine learning and artificial intelligence are likely to be valued far higher that what is justifiable from a business standpoint.

But these stories are anecdotal and not exactly representative of the actual investment landscape in tech.

So we drilled down the numbers behind investments done in 2024 so far, and how many of them were fundinds made in the Artificial intelligence space.

Research Methodology

Our research methodology was rather straightforward and relied heavily on collating data from multiple platforms, web-scraping and a bit of SQL.

Here's the step-by-step methodology

- Firstly, we collected funding data from Crunchbase and Apollo.io on companies who've received Equity Funding only in 2024 so far (uptil 15th of May)

- We them compiled this data, deduplicated it, cleaned it and ordered it

- Quite a few fund raises were from investment firms themselves in order to invest in other companies subsequently. In order to ensure consistency with the data, we excluded these fundraises altogether

- We were then left with a dataset that only included last-mile investments made directly to the beneficiary company

- Lastly, we scraped the company website, associated press articles, and official LinkedIn page to identify which of these firms mentioned any of - "generative AI", "artifical Intelligence", "machine learning" and other phrases associated with AI.

Key Insights

What we learnt was a mix of surprises and affirmations to what was already well known.

See the numbers for yourself below.

Number of Companies Funded

18% of companies that were funded in 2024 (Uptil 20th of May) had an element of "AI" mentioned in and around their product/service.

Rest of the 83 % businesses spanned both tech and non tech business models but were devoid of any element of AI in their services or business processes.

Thus underscoring the importance of innovation without necessarily jumping on the trends.

.png)

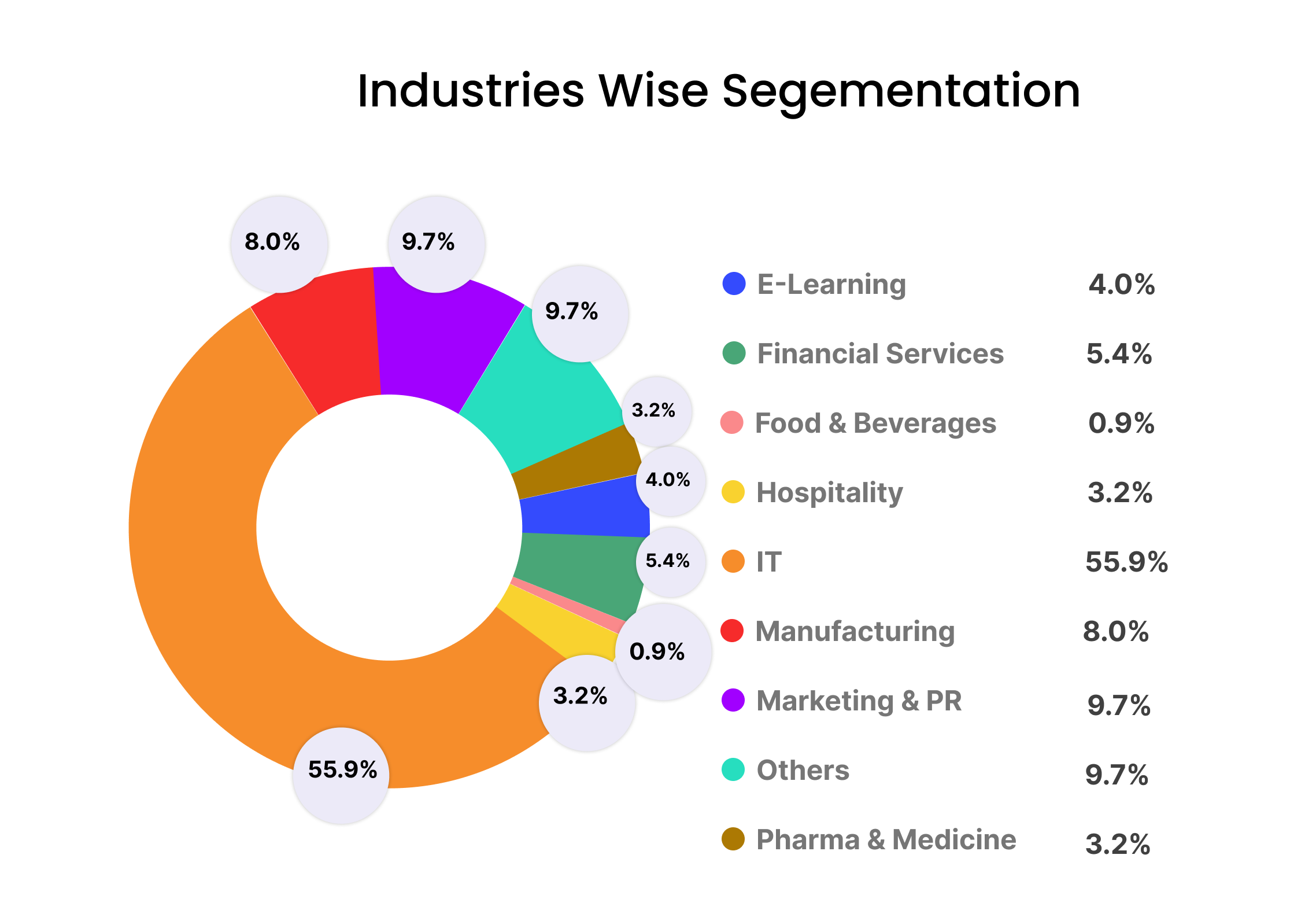

Which industries do these AI Funded companies belong to?

Within the range of data extracted for the AI funded companies , we even got our hands on the industry specific data pointing towards the major and minor industries these ai driven companies cover.

We've listed them below.

Automotive and IT sectors were among the first to recognize the importance of AI when the concept of AI/ML was introduced. The data presented indicates two major insights:

1. Two leading industries in the market have traditionally adopted AI and have experienced significant growth as a result.

2. There is a noticeable increase in AI dependency in smaller sectors, which previously did not see the need to incorporate machine learning to innovate and enhance their product or service offerings.

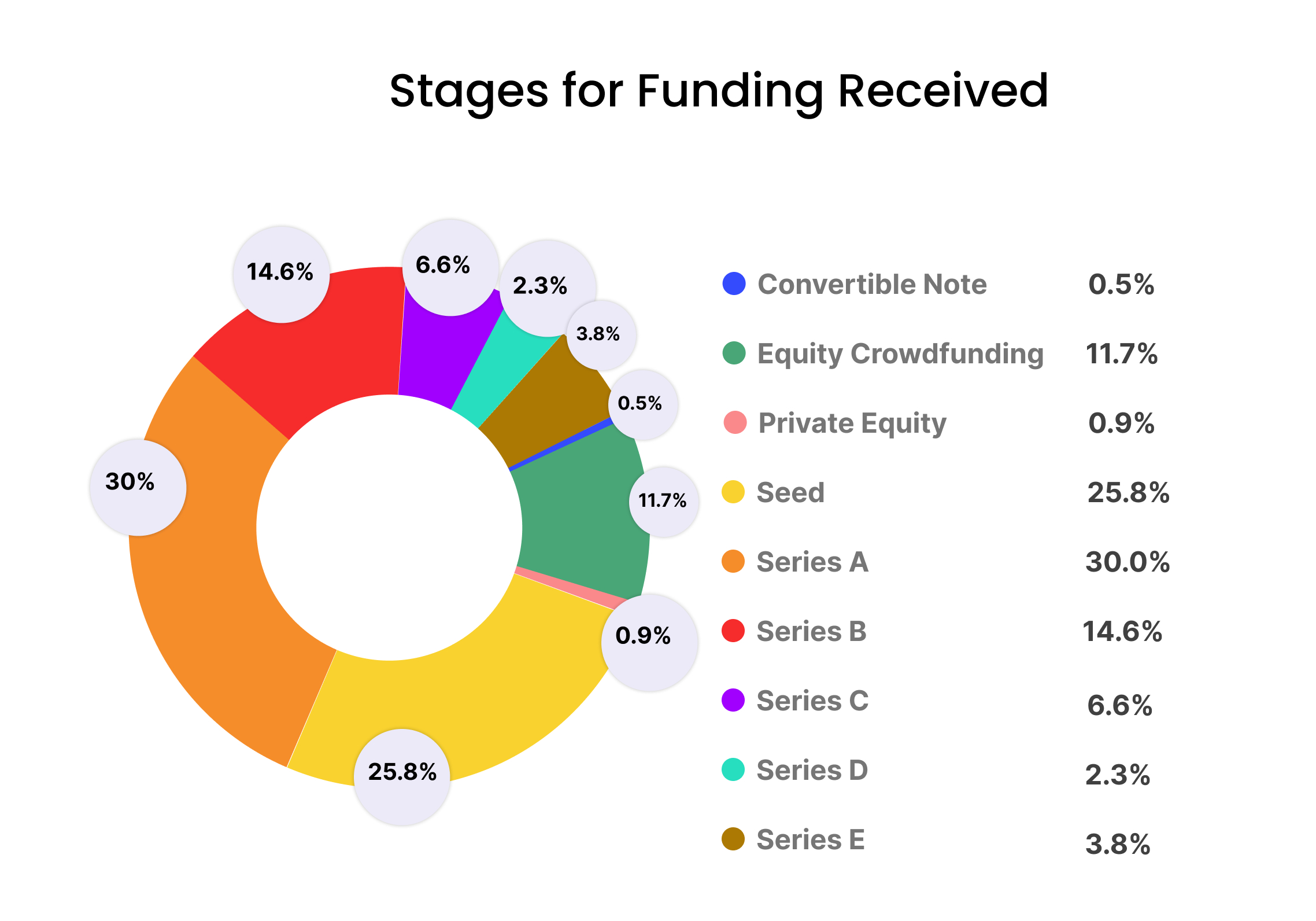

Series of Funding

Based on the data of companies that received funding and have 'AI' mentioned on their websites, the distribution of funding across various series is as follows

The funding distribution among AI-focused companies is indicative of their scope and lifecycle , reflecting different stages from early development to mature growth.

Here's a breakdown of the funding series and what they typically signify:

Series A

Series A is the first significant round of venture capital financing for a startup.

- This stage involves scaling the product, developing a strong business model, and starting to generate significant revenue.

- A significant percentage (30%) receiving Series A funding suggests strong early interest and potential in AI startups, indicating that many AI startups are attracting early investment to build their foundations.

Series B

Series B funding is used to take the business to the next level by expanding market reach, increasing operational capacity, and growing the team.

- This round focuses on scaling the business further and accelerating growth.

- The share of 15% in Series B indicates a reasonable number of companies are successfully scaling and attracting further investment to expand their market presence

Series C

Series C funding is for businesses that have proven themselves in the market.

- This round often involves scaling globally, entering new markets, and potentially preparing for an IPO.

- A percentage of 7% in Series C shows that some companies have proven market viability and are scaling further, though fewer companies reach this stage compared to Series A and B.

Series D

Series D funding can serve multiple purposes, such as addressing specific challenges, preparing for an IPO, or further expanding an already successful business.

- This stage is less common and typically indicates the company is nearing the final stages before going public or achieving significant milestones.

- Only 3% of AI companies are in this category, suggesting that fewer companies reach this advanced stage of funding, indicating either high success rates at earlier stages or strategic choices in funding rounds.

Series E

Series E funding is often used for final expansions, acquisitions, or to ensure the company is fully prepared for an IPO.

- This reflects a very mature and robust business looking to consolidate its market position or achieve specific strategic goals.

- 4% of AI companies at Series E indicates a smaller portion of businesses that are mature and well-established, focusing on substantial strategic moves or preparing for public listing.

Equity Crowdfunding

Equity crowdfunding involves raising small amounts of money from a large number of investors, typically via online platforms.

- This allows startups to access funding from the general public rather than traditional venture capitalists.

- A significant 12% of AI companies using equity crowdfunding suggests that many startups are leveraging this alternative funding method to support their early-stage development, reflecting democratized access to investment.

Private Equity

Private equity involves investments directly into private companies or buyouts of public companies, leading to their delisting.

- This funding is usually aimed at mature companies looking for significant capital to expand or restructure operations.

- Only 0.9% of AI companies receiving private equity indicates that few AI-focused companies are at the stage where they attract private equity investments, possibly due to the earlier stage nature of many AI companies or preference for remaining private.

The above mentioned funding distribution indicates a healthy investment landscape for AI companies, with a strong focus on early and mid-stage growth.

The majority of AI startups are attracting early-stage investments, enabling them to develop and scale their technologies.

The presence of equity crowdfunding highlights the increasing use of diverse funding sources, democratizing access to capital.

While fewer companies reach the advanced stages of Series D and E, those that do are well-positioned for significant strategic moves or public listing.

The low percentage of private equity involvement further emphasizes the nascent stage of many AI companies, with considerable growth potential still ahead.

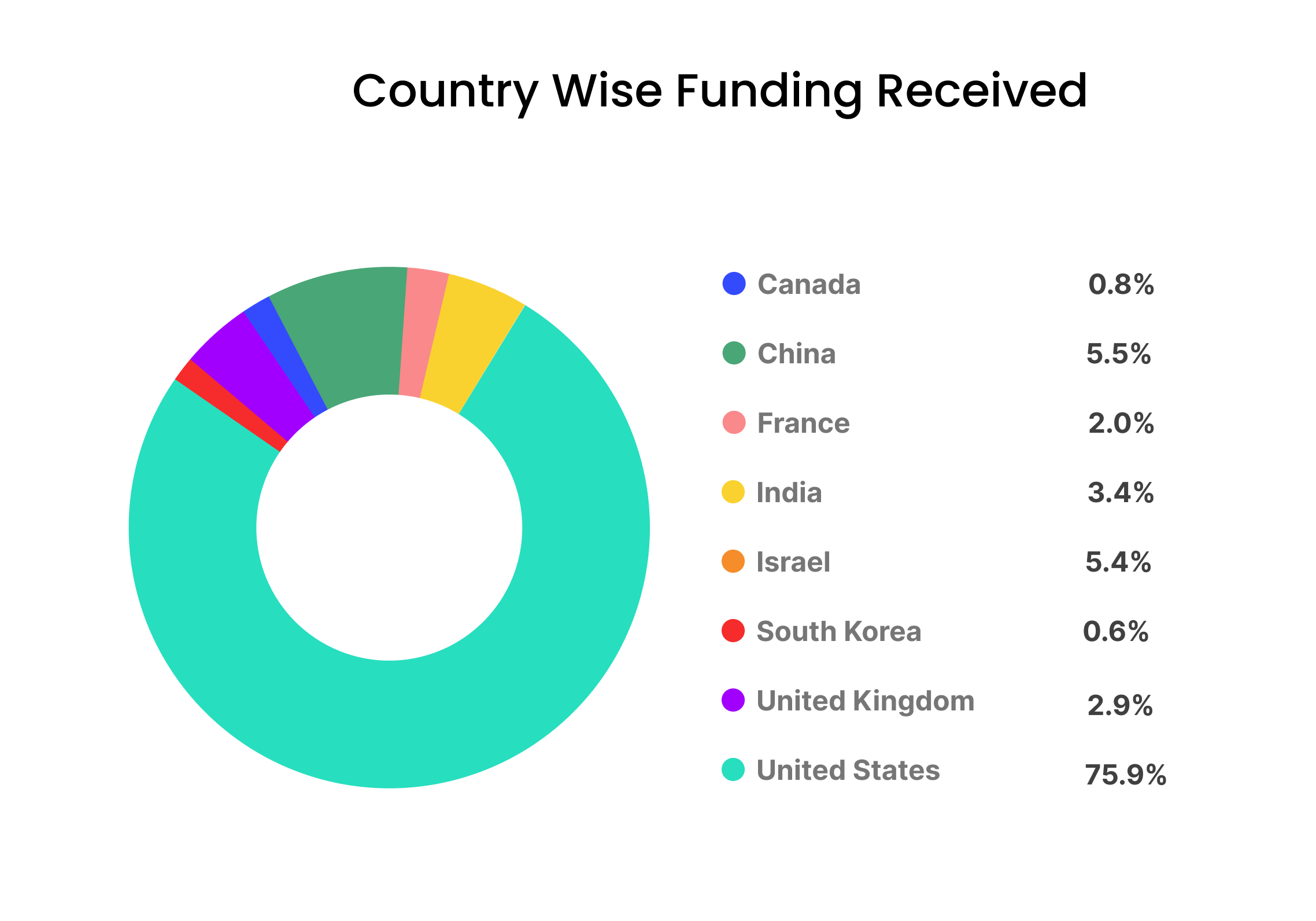

Country Wise Funding

While the exact validity of the data would depend on specific sources and the timeframe of the data collection, the general trend seems plausible based on current knowledge and trends in AI funding and innovation.

Here’s why these numbers might make sense

Global AI Funding Distribution by Country

The following percentages reflect the distribution of AI funding across various countries, highlighting their respective contributions to the global AI landscape. While the exact validity of the data depends on specific sources and the timeframe of data collection, these trends are plausible based on current knowledge and trends in AI funding and innovation.

United States

- Leading Innovation Hub: The US is a major hub for AI innovation, with significant investments from both private and public sectors.

- Venture Capital: The US has the most developed venture capital ecosystem, heavily investing in AI startups.

- Major Tech Companies: Tech giants like Google, Amazon, and Microsoft drive substantial AI research and funding.

- Conclusion: With 76% of the total AI funding, the US dominates the global AI landscape, driven by a robust venture capital ecosystem and leading tech companies.

China

- Government Strategy: The Chinese government’s strategic focus on AI aims to position the country as a global leader in AI by 2030.

- Large Market: China’s massive market provides extensive data, essential for AI development.

- Investment in AI: Significant investment in AI startups and research institutions is boosting China’s AI capabilities.

- Conclusion: China’s 6% share reflects its strategic and rapidly growing investment in AI, supported by government initiatives and a large market.

United Kingdom

- Research Excellence: The UK is home to top AI research institutions like Cambridge and Oxford.

- Government Support: Initiatives such as the AI Sector Deal support AI innovation.

- Startup Ecosystem: London and other cities host vibrant tech startup scenes, including AI companies.

- Conclusion: The UK’s 3% share indicates its strong focus on AI research and government-supported innovation.

Israel

- Innovation Hub: Israel is known for its thriving tech startup ecosystem and innovative culture.

- Government and Military Support: Strong government and military support for AI research and development.

- Global Partnerships: Collaborative efforts with global tech companies enhance AI capabilities.

- Conclusion: Israel’s 6% share highlights its significant role as an AI innovation hub with strong support from government and industry.

India

- Growing Tech Sector: India’s rapidly expanding tech industry includes many AI-focused startups.

- Government Initiatives: The National AI Strategy promotes AI research and development.

- Talent Pool: India has a large number of skilled tech professionals contributing to AI projects.

- Conclusion: India’s 4% share reflects its growing importance in the global AI landscape, driven by a strong talent pool and government initiatives.

France

- AI for Humanity Strategy: France’s national strategy emphasizes AI research and innovation.

- EU Collaboration: France benefits from European Union funding and collaborative projects.

- Research Institutions: Leading institutions contribute to AI advancements, attracting funding.

- Conclusion: France’s 2% share demonstrates its commitment to AI research and innovation, supported by national and EU initiatives.

Canada

- Pioneering AI Research: Canada is recognized for pioneering AI research, particularly in deep learning.

- Government Programs: The Pan-Canadian Artificial Intelligence Strategy supports AI growth.

- Tech Hubs: Cities like Toronto and Montreal are becoming key AI innovation hubs.

- Conclusion: Canada’s 0.8% share indicates its continued role in AI research and development, though with relatively smaller funding compared to larger players.

South Korea

- Tech Advancements: South Korea is known for its advanced technology sector and innovation.

- Government Support: Strong government initiatives to promote AI research and development.

- Industry Leaders: Companies like Samsung and LG are investing in AI technologies.

- Conclusion: South Korea’s 0.6% share reflects its growing focus on AI, supported by industry leaders and government initiatives.

What can we concur

- The data indicates that the US leads significantly in AI funding, which is consistent with its dominant position in the tech industry.

- Other countries like China, France, India, the UK, and Canada also receive substantial funding, reflecting their growing emphasis on AI research and development.

- The funding distribution highlights the global interest and investment in AI, with each country contributing uniquely to the advancement of AI technologies.

Like we mentioned in the beginning of the article, it seems quite likely that most investments into generative-AI based startups are likely to not yield the expected ROI.

However, investment decisions can be irrational and like in the case of the dot com bubble, it's likely that investors will continue to inflate the valuations of these startups citing future potential instead of justifiable revenue growth.

Some companies, undoubtedly, will emerge as the very leaders and pioneers in leveraging this technology for tangible benefits and with justifiable business results.

Similarly, there certainly will be a few bad apples who can hardly justify any commercial benefit of the technology, or worse, who don't leverage any form of artificial at all.

In 2024, there have been instances where companies misrepresented their involvement with AI to attract investors, a practice often referred to as "AI washing." The SEC has taken action against such deceptive practices.

For example, the SEC charged Delphia (USA) Inc. and Global Predictions Inc. with making false and misleading statements about their use of AI.

These firms claimed to use advanced AI technologies to attract investments, but investigations revealed they did not possess the AI capabilities they touted.

Delphia falsely advertised the use of AI for investment predictions, while Global Predictions falsely claimed to be the first regulated AI financial advisor and offered AI-driven forecasts without actually using such technologies (SEC.gov)

Conclusion

With investor funds pouring so heavily into the AI space with companies claiming to directly or indirectly incorporate machine learning models into their processes, it is quite pertinent to understand whether this piece of technology will be harnessed as the next revolutionary innovation or simply as an instrument to woo investors at exorbitant valuations.

It is quite likely that we will witness another phenomenon similar to the dot-com era bubble wherein companies that raised funds at unjustifiable valuations perished shortly after but firms that truly harnessed the power of the internet went-on to slowly but steadily become tech giants in their own right.