Guide to setup mobile app payment gateway

Introduction

In today's digital world, mobile apps are essential for shopping,

banking, and more. To succeed, your app needs a seamless and secure payment experience.

Payment gateways connect customers with financial institutions, ensuring smooth and safe transactions. A well-integrated gateway boosts user trust and app credibility.

This guide covers everything you need to know about setting up a payment gateway for

your mobile app, from types and features to integration and trends. Let's get started!

Types of Payment Gateways

There are various types of payment gateways available, each with its own features and benefits. Here are the main types you should know about:

Hosted Payment Gateways:

Redirects customers to a secure payment page hosted by the gateway provider. Examples include PayPal and Stripe.

Pros: Easy to implement and highly secure.

Cons: Customers leave your app for the payment process.

Self-Hosted Payment Gateways

Payment forms are created and hosted on your own server. Examples include WooCommerce and Magento.

Pros: Full control over the payment process and user experience.

Cons: Requires strong security measures and compliance with PCI DSS.

API/Non-Hosted Payment Gateways

Provides APIs for you to integrate the payment gateway directly into your app. Examples include Authorize.Net and Braintree.

Pros: Seamless user experience as customers stay on your app.

Cons: Complex to implement and maintain.

Local Bank Integrations

Direct integration with local banks for processing payments.

Pros: Good for businesses with a local customer base.

Cons: Limited to specific regions and may lack global reach.

Mobile Payment Gateways

Designed specifically for mobile apps and mobile wallets. Examples include Apple Pay, Google Pay, and Samsung Pay.

Pros: Optimized for mobile devices and often provide a faster checkout experience.

Cons: May require additional setup and compliance.

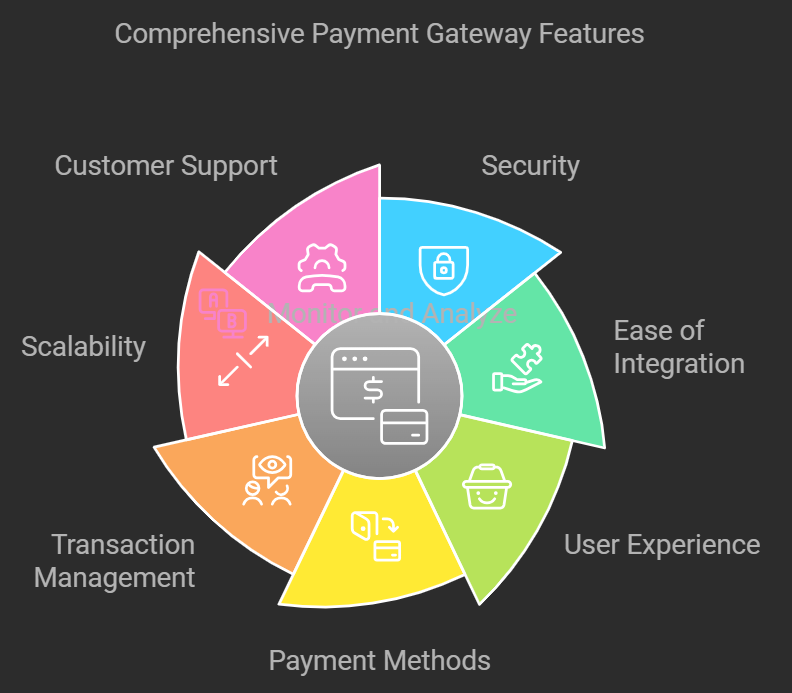

Key Features of Payment Gateways

When selecting a payment gateway for your mobile app, it's crucial to consider the following key features:

Security

PCI-DSS Compliance: Ensure that the gateway complies with the Payment Card Industry Data Security Standard for handling card information securely.

Fraud Detection: Features like encryption, tokenization, and advanced fraud monitoring can protect against fraudulent activities.

Ease of Integration

APIs and SDKs: Look for gateways that provide robust APIs and Software Development Kits for easy integration with your app.

Documentation and Support: Comprehensive documentation and responsive technical support can significantly ease the integration process.

User Experience

Seamless Checkout: A smooth and fast checkout process can reduce cart abandonment and improve user satisfaction.

Mobile Optimization: Ensure the payment gateway is optimized for mobile devices, providing a user-friendly experience.

Payment Methods

Multiple Payment Options: Support for various payment methods including credit/debit cards, digital wallets, bank transfers, and more.

Global Currency Support: Ability to handle multiple currencies if you have an international customer base.

Transaction Management

Dashboard and Reporting: Access to a comprehensive dashboard for monitoring transactions and generating reports.

Refunds and Chargebacks: Easy handling of refunds and chargebacks to maintain customer trust and satisfaction.

Scalability

Handling Volume: Ability to process a high volume of transactions as your business grows.

Flexible Pricing Plans: Pricing models that can adapt to your business size and transaction volume.

Customer Support

24/7 Availability: Round-the-clock customer support to address any issues promptly. Multiple Channels: Availability of support through various channels like chat, email, and phone.

Factors to Consider While Choosing a Payment Gateway

Selecting the right payment gateway is crucial for providing a seamless and secure payment experience. Here are key factors to consider:

Security

- Ensure the gateway complies with PCI-DSS standards.

- Look for features like encryption and fraud detection to protect against unauthorized transactions.

Transaction Fees and Costs

- Compare setup fees, transaction fees, and any other hidden costs.

- Consider the gateway's pricing model and how it aligns with your business volume and growth.

Integration Ease

- Check if the gateway offers APIs and SDKs for easy integration.

- Look for comprehensive documentation and responsive technical support.

User Experience

- Choose a gateway that offers a smooth and fast checkout process.

- Ensure it is mobile-optimized for users on smartphones and tablets.

Payment Methods

- Ensure the gateway supports a variety of payment options, including credit/debit cards, digital wallets, and bank transfers.

- Consider support for multiple currencies if you have an international customer base.

Reputation and Reliability

- Research the gateway provider's reputation and reliability.

- Look for reviews, ratings, and case studies from other businesses.

Customer Support

- Ensure the provider offers 24/7 support through multiple channels like chat, email, and phone.

- Look for providers with a good track record of resolving issues promptly.

Scalability

- Choose a gateway that can handle increasing transaction volumes as your business grows.

- Check if the pricing plans are flexible and can adapt to your growth.

Settlement Speed

- Consider how quickly the gateway settles funds into your account.

- Faster settlement can improve your cash flow management.

Additional Features

- Look for features like recurring billing, invoicing, and advanced reporting.

- Consider whether the gateway offers tools for managing refunds and chargebacks.

Popular Payment Gateway Providers

Here are some of the most popular payment gateway providers, each offering unique features and benefits:

.png)

Stripe

Pros: Highly customizable, supports a wide range of payment methods, and offers robust APIs for easy integration.

Cons: Transaction fees can be higher for smaller businesses.

PayPal

Pros: Widely recognized and trusted, supports global payments, and offers buyer protection.

Cons: Higher fees compared to some other providers.

Adyen

Pros: Comprehensive payment solutions, supports multiple currencies, and provides excellent customer support.

Cons: Can be complex to set up and manage.

Square

Pros: Ideal for small to medium-sized businesses, easy to use, and offers additional services like point-of-sale systems.

Cons: Transaction fees can add up for high-volume businesses.

Authorize.Net

Pros: Strong security features, reliable customer support, and easy integration with existing systems.

Cons: Higher setup fees and transaction costs.

Braintree

Pros: Supports a wide range of payment methods, including digital wallets, and offers excellent developer tools.

Cons: Can be more expensive than other options.

2Checkout

Pros: Supports multiple currencies and payment methods, easy to integrate, and offers recurring billing options.

Cons: Higher fees for certain payment methods.

Paytm Business

Pros: Popular in India, supports various payment methods including UPI and Paytm Wallet, and easy to set up.

Cons: Limited to the Indian market.

Razorpay

Pros: Popular in India, supports multiple payment methods, and offers easy integration.

Cons: Higher fees for certain payment methods.

Amazon Payment Services

Pros: Integrates well with Amazon's ecosystem, supports multiple payment methods, and offers good customer support.

Cons: Can be more expensive for non-Amazon businesses.

Benefits of Supporting Wallets like Apple Pay and Google Pay

Integrating digital wallets like Apple Pay and Google Pay into your mobile app offers several significant benefits:

Enhanced Security

Tokenization: Replaces sensitive card information with unique tokens, reducing fraud risk.

Biometric Authentication: Users can authenticate payments using fingerprint or facial recognition.

Faster Checkout Process

One-Touch Payments: Users can complete transactions with a touch or a glance, speeding up the checkout process.

Stored Payment Information: Eliminates the need for users to enter payment details repeatedly.

Increased Conversion Rates

User Convenience: The ease and speed of using digital wallets can lead to higher conversion rates.

Familiarity and Trust: Many users trust Apple Pay and Google Pay, enhancing confidence in purchases.

Global Reach

Multiple Currencies: Supports multiple currencies, making it easier to cater to an international audience.

Cross-Border Payments: Facilitates cross-border transactions, expanding market reach.

Customer Loyalty

Enhanced User Experience: Providing a convenient and secure payment option improves user satisfaction and loyalty.

Promotions and Rewards: Many digital wallets offer their own promotions and rewards, adding value for your customers.

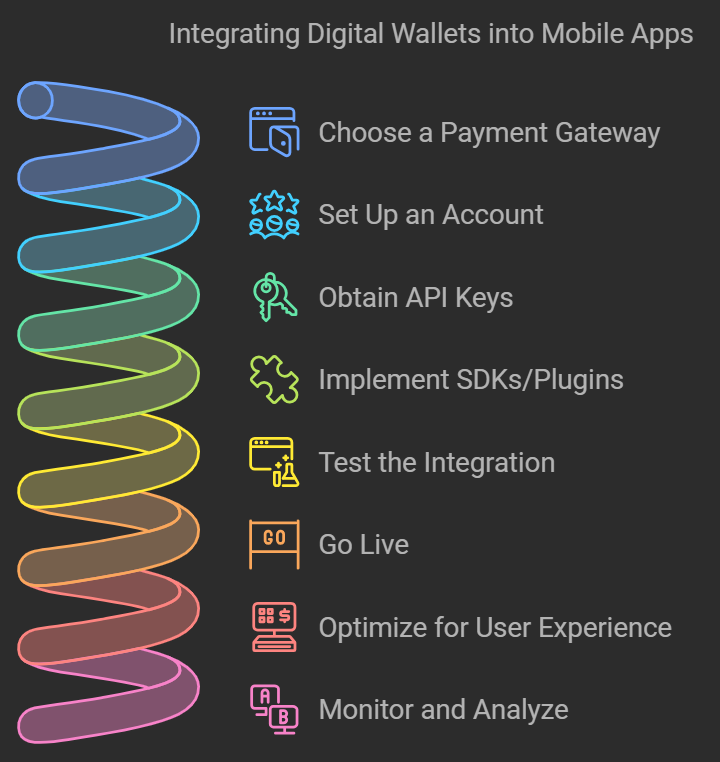

Steps to Integrate Digital Wallets

Integrating digital wallets into your mobile app can enhance the user experience and streamline transactions. Here are the key steps to follow:

Choose a Payment Gateway

Select a payment gateway that supports the digital wallets you want to integrate, such as Stripe, PayPal, or Adyen.

Set Up an Account

Create an account with the chosen payment gateway and configure your business settings, including payment methods and currencies.

Obtain API Keys

Get the necessary API keys from the payment gateway to enable integration with your app.

Implement SDKs/Plugins

Use the provided SDKs (Software Development Kits) or plugins to integrate the payment gateway into your app. Follow the documentation for proper setup.

Test the Integration

Conduct thorough testing to ensure the integration works smoothly. Test different payment scenarios, including successful transactions, refunds, and error handling.

Go Live

Once testing is complete and everything is working correctly, go live with the integration. Monitor transactions closely to address any issues promptly.

Optimize for User Experience

Ensure the payment process is seamless and user-friendly. Optimize the checkout flow to minimize friction and reduce cart abandonment.

Monitor and Analyze

Regularly monitor transaction data and analyze performance. Use insights to improve the payment process and address any issues that arise.

Analyzing Payment Data

Analyzing payment data is vital for optimizing the payment process and improving business strategies. Here are the key points to focus on:

Collect Data

Gather transaction data, including amounts, methods, and timestamps.

Identify Key Metrics

Focus on conversion rate, average transaction value, transaction volume, failure rate, and chargeback ratio.

Analyze Trends

Look for patterns in transaction data to identify peak times and popular payment methods.

Segmentation

Segment data by user demographics, payment methods, and regions to understand different behaviors.

Actionable Insights

Use the analysis to optimize the checkout process and offer new payment options, improving user experience and business performance.

Future Trends in Mobile Payment Gateways

The mobile payment landscape is rapidly evolving, driven by technological advancements and changing consumer behaviors. Here are the key trends to watch:

Contactless Payments

Methods like NFC and QR code transactions are becoming increasingly popular for their speed and hygiene.

Biometric Authentication

Fingerprint and facial recognition offer secure, user-friendly alternatives to passwords.

Super Apps

These apps integrate various services, like payments and social media, into one platform, enhancing user convenience.

Cryptocurrencies

Digital currencies are being adopted for mobile transactions, offering new payment options.

Mobile Wallets

Wallets are evolving to include features like budgeting and rewards, making them multi-functional tools.

FAQs (Frequently Asked Questions)

Here are some frequently asked questions about setting up mobile app payment gateways:

What is a payment gateway?

A payment gateway processes credit card payments for online and offline businesses, acting as an intermediary between a merchant and their customers.

Why do I need a payment gateway for my mobile app?

It ensures secure transactions, supports various payment methods, and provides a seamless checkout process.

How do I choose the right payment gateway for my app?

Consider factors such as security, transaction fees, integration ease, user experience, payment methods supported, and customer support.

How do I integrate a payment gateway into my mobile app?

Set up an account with the provider, obtain API keys, and use their SDKs or APIs for integration, following the documentation provided.

Conclusion

Setting up a payment gateway for your mobile app is essential for providing a secure and seamless transaction experience. Here are the key takeaways:

Understanding Payment Gateways: Know the different types and their features to select the right one.

Choosing the Right Provider: Consider security, costs, integration ease, and support.

Supporting Digital Wallets: Enhance user convenience and security by integrating Apple Pay, Google Pay, etc.

Analyzing Data: Use transaction data to optimize processes and improve user experience.

Staying Updated: Keep an eye on future trends to adapt and innovate.