Introduction

The integration of finance and technology—Fintech—has revolutionized how we save, invest, borrow, and insure. At the heart of this transformation lies machine learning (ML), a branch of artificial intelligence that enables systems to learn from data and improve over time without being explicitly programmed.

Machine learning is no longer just a buzzword; it’s the backbone of modern financial services.

From fraud detection to robo-advisors, ML is shaping the future of finance. In this blog, we’ll explore the core applications, benefits, challenges, and examples of ML in fintech.

What is machine learning?

Machine learning is a subset of AI that focuses on creating systems that can analyze and learn from data patterns and then make decisions or predictions. ML algorithms are especially useful in industries with massive amounts of structured and unstructured data, like finance.

Why fintech needs machine learning

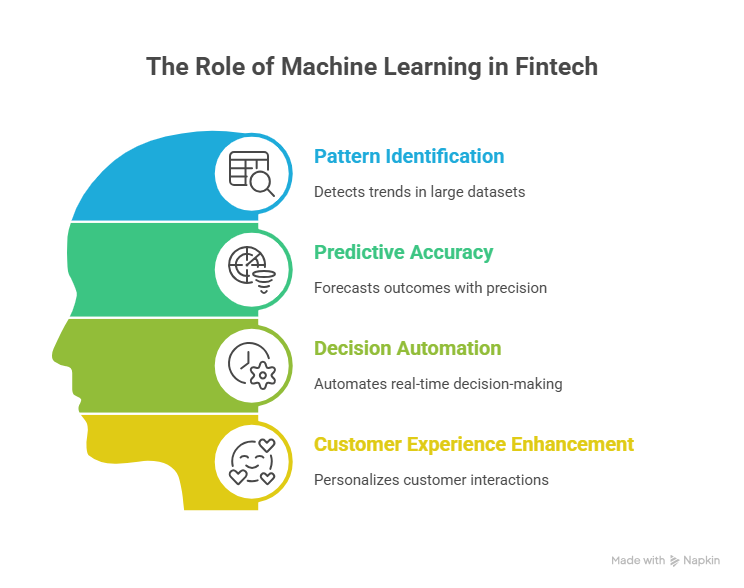

The financial industry generates petabytes of data every day from transactions, stock movements, user behavior, credit histories, etc. Machine learning thrives in such environments because it can:

Identify patterns in massive datasets

- Predict outcomes with high accuracy

- Automate decision-making in real-time

- Enhance customer experience through personalization

Key applications of machine learning in fintech

1. Fraud detection and prevention

The problem:

Traditional rule-based fraud detection systems are rigid and often generate false positives, which can frustrate users and miss new fraud tactics.

How ML solves it:

Machine learning brings real-time, adaptive security. It doesn’t rely solely on predefined rules. Instead, it learns from past transaction data and continuously improves its ability to identify fraudulent patterns.

- Unsupervised Learning: Detects anomalies in transaction behavior, even without labeled fraud examples.

- Supervised Models: Algorithms like random forests and neural networks are trained on historical fraud cases to predict new ones.

Benefits:

- Dramatically lowers false positives (less frustration for genuine users).

- Speeds up detection from hours to milliseconds, helping prevent fraud before it happens.

Case study:

PayPal uses ML to analyze over 1 billion transactions per day, achieving 90%+ accuracy in fraud detection while minimizing disruptions for legitimate customers.

2. Credit scoring and risk assessment

The problem:

Millions of people are denied loans not because they’re risky, but because they don’t have a credit history. Traditional scoring models (like FICO) don’t consider alternative data.

ML advantage:

Machine learning can evaluate non-traditional data sources, making credit more inclusive:

- Rent, utility bills, and mobile phone payments

- Online shopping behavior and even social signals

- Natural language analysis from loan applications

ML models used:

- Logistic regression

- Gradient boosting machines (like XGBoost)

- Deep learning networks

Impact:

- Broader credit access, especially for “thin-file” applicants.

- More accurate predictions of default risk.

Output:

Upstart reduced defaults by 27% using ML-based scoring while still approving more applicants than traditional methods.

3. Robo-advisors

The problem:

Traditional financial advisors can be expensive and are often out of reach for average investors.

ML in action:

Robo-advisors use machine learning to offer automated, personalized investment advice based on a user’s risk profile and goals.

- Constant portfolio rebalancing

- Adaptive risk management

- Tax-loss harvesting to reduce tax liabilities

Techniques used:

- Reinforcement learning

- Predictive analytics

- Portfolio optimization algorithms

Leading platforms:

Betterment and Wealthfront use ML to manage billions in assets, offering human-like advice at a fraction of the cost.

4. Algorithmic trading

The problem:

Markets move quickly, and human traders can't keep up with high-frequency trading needs.

ML in action:

Machine learning enables automated, predictive trading strategies that analyze massive datasets in real time:

- News sentiment via Natural Language Processing (NLP)

- Price trends using time-series forecasting

- Adaptive strategies with reinforcement learning

Impact:

These strategies react in milliseconds, giving traders a competitive edge in capturing profits or avoiding losses.

Industry example:

Renaissance Technologies, a top hedge fund, uses sophisticated ML and statistical models to consistently outperform the market.

5. Customer support with chatbots

The problem:

24/7 customer support is expensive and hard to scale.

ML-powered chatbots:

Chatbots built with machine learning and NLP can handle thousands of customer inquiries with high accuracy and human-like interaction.

- Understand and respond in natural language

- Improve over time through continuous learning

- Hand off complex queries to human agents

Example:

HDFC Bank’s chatbot Eva has handled 5+ million queries across topics like balance checks, EMI plans, and loan advice, improving efficiency and customer satisfaction.

6. Personalized financial services

The problem:

Generic financial advice doesn’t resonate with users who want personalized help managing their finances.

Machine learning enables hyper-personalized recommendations:

- Alerts for unusual spending behavior

- Predictions for future expenses or income

- Smart saving tips based on goals and habits

Techniques used:

- Clustering algorithms to group user behaviors

- Behavioral segmentation

- Predictive analytics for future financial states

Examples:

- Cleo offers friendly, AI-powered budget advice.

- YNAB (You Need A Budget) dynamically adjusts spending plans to real-time financial behavior.

Benefits of using machine learning in fintech

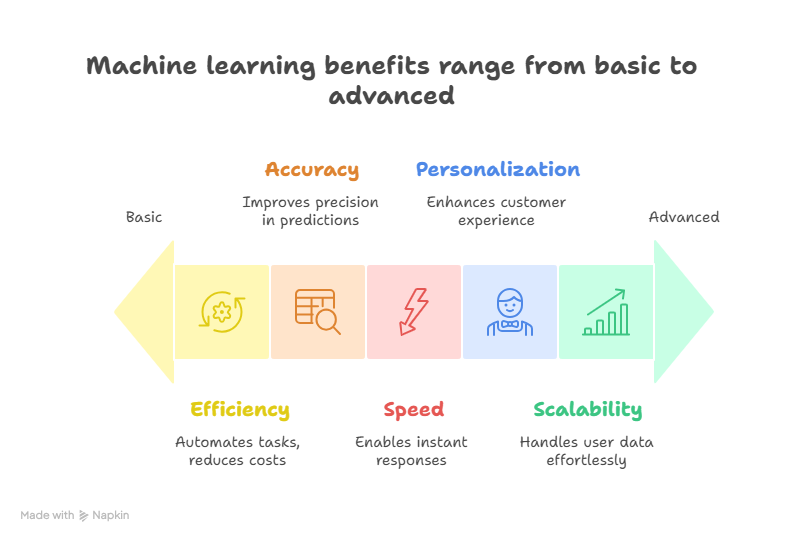

Efficiency

- Machine learning automates time-consuming tasks like document verification, loan processing, and transaction monitoring.

- This reduces manual effort, improves workflow speed, and cuts operational costs significantly.

Accuracy

- ML models continuously learn from historical and real-time data to improve decision-making accuracy.

- This helps in fraud detection, risk analysis, and credit scoring with fewer false positives or missed threats.

Speed

- In finance, milliseconds matter. ML enables real-time fraud alerts, instant approvals, and faster market reactions.

- It processes data at scale without delay, improving user experience and business responsiveness.

Personalization

- ML helps deliver hyper-personalized services like spending insights, tailored investment plans, and smart alerts.

- It boosts user engagement by adapting to each customer’s financial behavior and preferences.

Scalability

- As your user base and data grow, ML systems scale effortlessly—maintaining speed and accuracy.

- This is key for fintech apps dealing with millions of users and dynamic market conditions.

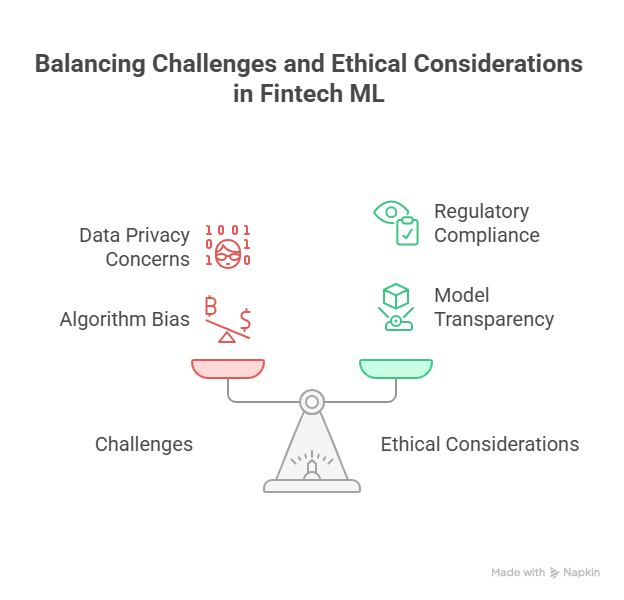

Challenges and ethical considerations

Despite its advantages, ML in fintech also presents challenges:

Data privacy

- Machine learning requires vast amounts of personal financial data, raising concerns about how this data is collected, stored, and used.

- Fintech companies must ensure strong encryption, data minimization, and compliance with privacy laws like GDPR.

Bias in algorithms

- ML models can inherit biases from the data they’re trained on, like gender, race, or income bias.

- This can result in unfair loan approvals, credit scoring, or investment suggestions, damaging trust and reputation.

Regulatory compliance

- Fintech is heavily regulated, and ML models must comply with laws that can vary by region and change frequently.

- Staying compliant while innovating with ML requires constant monitoring, updates, and legal oversight.

Model transparency

- Advanced models like neural networks often operate as “black boxes,” making their decisions hard to explain.

- This lack of interpretability challenges auditing, builds skepticism, and may conflict with legal requirements for explainability.

The future of machine learning in fintech

As technology advances, we can expect:

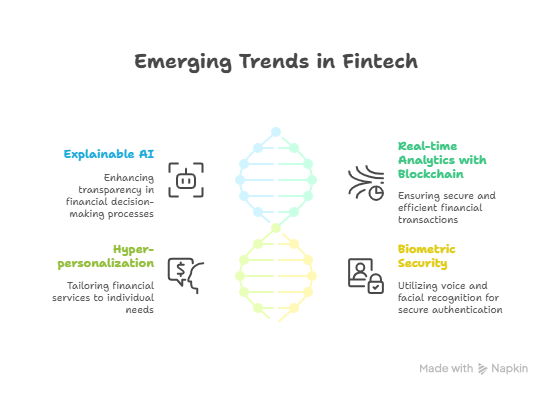

Explainable AI

- Future ML systems will be more transparent, allowing users and regulators to understand why decisions were made.

- This boosts trust, supports compliance, and reduces the risks of black-box models.

Real-time analytics with blockchain

- Combining ML with blockchain will enable secure, tamper-proof financial transactions analyzed in real time.

- This will enhance fraud detection, auditing, and transaction transparency.

Hyper-personalization

- ML will deliver ultra-personalized experiences, custom investment plans, tailored insurance packages, and real-time financial advice.

- User data and preferences will drive financial products like never before.

Biometric security

- Voice, face, and behavioral recognition will become standard in financial authentication.

- This adds a strong layer of security while simplifying the user experience.

Final thoughts

Machine learning is not just enhancing fintech; it's redefining it.

From risk management to customer engagement, ML continues to unlock new opportunities in the financial sector.

However, companies must balance innovation with responsibility to ensure trust, transparency, and compliance.

If you’re a fintech startup or an established institution, investing in machine learning is no longer optional.